Explore The Top eCommerce Payment Gateways in Saudi Arabia

Table of Contents

The digital revolution in Saudi Arabia has altered how eCommerce operates. With Saudi’s vision of 2030, online shopping has significantly contributed to business growth. Hence, choosing the right Payment gateways is crucial for all business sizes. These factors are majorly important for increasing consumer trust and business success.

According to a Saudi Central Bank study, electronic payments have surpassed cash payments by 91% and are expected to total .3 billion by 2025. This shift in payment choice results from the changing behaviour of new-age Saudi customers who choose online shopping. Hence, the right payment gateway is the key factor for growing business excellence.

Let’s explore the best payment gateway options for Saudi e-commerce businesses in this blog.

Key Factors For Selecting The Right Payment Gateway

Identifying and selecting the right payment gateway is the key to your business’ success. Hence, choosing the perfect gateway for your business is essential; let’s explore the critical factors below:

Security Concerns

When handling financial aspects, it is critical to prioritise security. To protect sensitive customer information, a trustworthy payment gateway uses advanced encryption and adheres to industry standards. Using a secure payment gateway protects your customers’ information while increasing trust and credibility in your brand.

Seamless user experience

A smooth checkout process reduces cart abandonment and keeps customers satisfied. A good payment system allows customers to easily complete their purchases. Choose a payment system that accepts one-click payments and provides various payment options to make purchasing easier.

Choose The Right Payment Option

Understanding who you’re attempting to reach and which payment methods they prefer is critical. Payment preferences vary by region; some prefer credit cards, while others prefer local payment methods. Choosing a payment gateway that accepts local payments can make things easier for customers while also increasing sales.

Transaction Costs and Charges

Each payment gateway has its fee structure, so you must be careful when selecting one. Platform fees include transaction charges, as well as monthly and annual fees. Therefore, choosing a payment gateway with transparent pricing can help you increase revenue effectively.

Essential Features of a Right Payment Gateway

Selecting the appropriate payment gateway is critical when running an online store. Consider these key features to ensure your customers’ transactions run smoothly, securely, and conveniently.

High-level Security

In today’s digital age, it is critical to prioritise security. Ensure your payment gateway has strong security measures, such as SSL encryption and PCI compliance, to protect customer data and ensure secure transactions. This will increase trust and protect your business from potential security breaches.

Multiple payment options

Your customers expect a variety of payment options. Choose a gateway that accepts a variety of methods, such as credit and debit cards, e-wallets, and bank transfers, to provide a frictionless experience and meet a wide range of customer preferences.

Mobile compatibility

With the majority of online shoppers making purchases on mobile devices, a mobile-friendly payment gateway is critical. Look for a solution optimised for mobile payments that provides a consistent experience across all devices.

Multicurrency support

Multicurrency support is required when catering to a global audience. Payment gateways that allow customers to pay in their preferred currency reduce friction and improve the overall shopping experience, resulting in increased international sales.

Integration with eCommerce platforms

A payment gateway should be easy to integrate with your eCommerce platform, whether it is Shopify, Magento, WooCommerce, or another system. This ensures a simple setup, efficient transaction processing, and minimal disruption to your operations.

Customer support and ease of use

Whether you run a small or large business, dependable customer service is essential. Choose a payment gateway that provides responsive support and a simple interface for quick troubleshooting, ensuring a positive experience for both you and your customers.

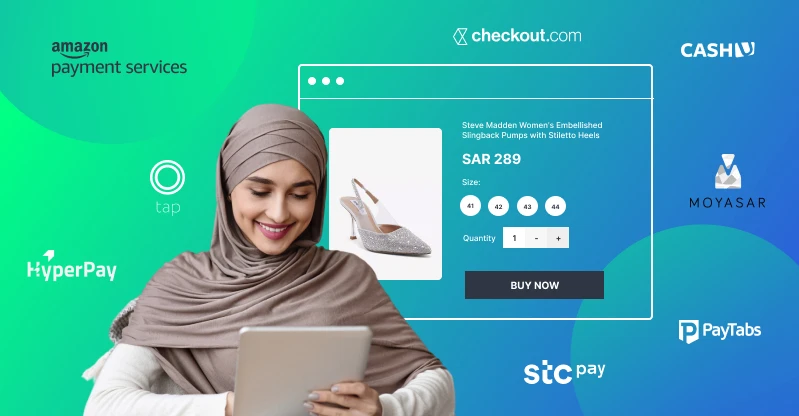

Top eCommerce Payment Gateways in Saudi Arabia

Let’s explore the top payment gateways in the Saudi eCommerce market. Each has a set of features to meet the needs of various businesses.

PayTabs

PayTabs is a Saudi-based payment gateway that accepts multiple currencies and charges low transaction fees. It is trusted for its secure and flexible solutions and processes, over a billion annually across the MENA region.

Key Features:

- Multi-currency options: PayTabs allows businesses to accept payments in Saudi Riyal (SAR) and other international currencies, making it ideal for companies with a global customer base.

- Seamless integration: PayTabs easily integrates with major eCommerce platforms like Shopify, WooCommerce, and Magento, providing a hassle-free setup.

- Top-notch security: It is PCI-DSS compliant, ensuring the highest standards in payment security with fraud protection to safeguard businesses and customers.

- Wide range of payment options: PayTabs supports payments via credit cards, debit cards, and local payment methods like SADAD, making it accessible to a broader audience.

HyperPay

HyperPay is a widely used payment gateway in the Middle East and North Africa. Large businesses prefer it because it can handle high transaction volumes with little downtime. More than 200 million transactions can be made with this payment method annually to provide a seamless payment experience to end users.

Key Features:

- Scalability: HyperPay is designed to handle high transaction volumes, making it ideal for fast-growing businesses or those experiencing seasonal spikes in sales.

- Diverse payment options: It supports multiple payment methods, including credit/debit cards, MADA, and SADAD, ensuring convenience for local consumers.

- Integration: HyperPay offers simple integration with popular eCommerce platforms, making it easy for businesses to implement.

- Advanced security: The gateway offers robust fraud prevention systems and is PCI-DSS compliant, ensuring safe transactions for merchants and customers.

STC Pay

STC Pay is a popular mobile wallet in Saudi Arabia, backed by the Saudi Telecom Company (STC). It offers a convenient mobile payment option, which more than 7.4 million Saudis use.

Key Features:

- Mobile wallet integration: STC Pay supports easy integration with eCommerce websites, making it convenient for businesses to accept mobile wallet payments.

- Versatile payment support: STC Pay enables both in-app and online payments, allowing businesses to cater to mobile shoppers.

- Trust and adoption: STC Pay enjoys widespread trust and adoption across Saudi Arabia.

- Local payment methods: STC Pay supports local payment methods like MADA and SADAD, further enhancing its accessibility for local consumers.

Tap Payments

Tap Payments is a reliable payment gateway in the Middle East that offers easy access to various payment options. It is appropriate for businesses of all sizes due to its user-friendly interface and flexible pricing options.

Key Features:

- Over 100 payment methods: Tap Payments supports a variety of payment methods, including Apple Pay, Visa, Mastercard, and local options like SADAD, ensuring maximum convenience for consumers.

- High-security standards: Tap Payments is PCI-DSS certified, providing strong security measures to protect both merchants and consumers.

- Easy setup: Businesses can quickly integrate Tap Payments with various eCommerce platforms, streamlining the onboarding process.

- Flexible pricing plans: The gateway offers different pricing models, allowing businesses to choose the one that best suits their needs.

Checkout.com

Saudi businesses frequently use Checkout.com to process payments. This option is preferable for domestic and international payments, and the best part is it offers advanced security measures.

Key Features:

- Local and international payment support: Checkout.com supports local payment methods like MADA and SADAD, as well as international options like Visa and Mastercard.

- Advanced fraud detection: Its sophisticated fraud detection systems ensure that businesses are protected against malicious activity.

- Real-time analytics: Checkout.com offers comprehensive analytics and reporting tools, allowing businesses to make data-driven decisions.

- Integration: It easily integrates with most major eCommerce platforms, providing a smooth implementation process.

Payfort (Amazon Payment Services)

Payfort, now known as Amazon Payment Services, was acquired by Amazon and is a robust payment gateway designed for Middle Eastern businesses. It accepts various payment methods and currencies, making it reliable for all kinds of businesses.

Key Features:

- Multiple currency support: Payfort enables businesses to accept payments in different currencies, offering a competitive edge for international transactions.

- Diverse payment methods: It supports a range of payment options, including Visa, MasterCard, and SADAD.

- Advanced fraud detection: Payfort is renowned for its powerful fraud detection capabilities, ensuring a secure environment for online transactions.

Moyasar

Moyasar offers flexible payment options for domestic and international businesses. Developers prefer it due to its simple API and extensive documentation.

Key Features:

- Multiple payment methods: Moyasar supports payments via credit cards, SADAD, and Apple Pay, making it versatile for businesses with a diverse customer base.

- Developer-friendly API: Moyasar’s API is easy to integrate, allowing developers to quickly set up and customize payment solutions.

- Localized support: It is tailored to the needs of businesses operating in Saudi Arabia, providing localized payment methods and a smooth user experience.

CASHU

CASHU is a popular payment gateway in the Middle East, mainly used by businesses operating in the MENA region. This payment gateway is known for its high-level security for online transactions.

Key Features

- Wide payment support: CASHU supports a variety of payment methods, offering flexibility for both merchants and customers.

- Robust fraud protection: With a focus on security, CASHU provides advanced fraud prevention systems to ensure safe and reliable transactions.

- Regional popularity: It is a well-known brand in the MENA region, particularly used by businesses catering to local consumers.

Conclusion

Identifying the right payment gateway is a major factor for any business. There are a lot of payment gateways available in Saudi. All the payment options come with a list of unique features and benefits. The eCommerce owners must assess their key requirements and identify the best option for their business. Consulting with eCommerce experts can provide you with tailored insights and solutions for integrating the best payment gateway in Saudi Arabia.