Retail Trends for 2025: What Every Business Owner Needs to Know

Table of Contents

Saudi Arabia’s retail landscape is rapidly evolving, fueled by economic diversification goals outlined in Vision 2030, a youthful tech-savvy population, and the increasing influence of global retail practices.

The Kingdom’s retail sector, once dominated by traditional shopping habits, is now embracing digital commerce, mobile-first strategies, and omnichannel experiences.

With over 70% of the population under the age of 35 and widespread smartphone usage, retailers must adapt to cater to a demographic that expects immediacy, personalisation, and convenience.

Government investments in digital infrastructure, logistics, and eCommerce regulations have created an environment conducive to retail innovation.

Initiatives like the National Digital Transformation Program and partnerships with global tech players are driving the adoption of technologies such as AI, AR/VR, and cloud computing across retail operations.

Furthermore, the rise of domestic and regional retail brands shows the Kingdom’s growing appetite for entrepreneurship and localisation.

Retailers in Saudi Arabia must not only keep up with global trends but also localise them to suit cultural nuances and consumer behaviours.

From integrating Islamic finance in payment systems to offering gender-sensitive in-store designs, trend adaptation must be thoughtful and contextual. In 2025, the retailers who stay ahead of the curve—adopting trends before they become mainstream—will have a decisive edge in customer loyalty, operational efficiency, and profitability.

This blog explores key trends transforming Saudi retail in 2025, helping businesses future-proof their strategies and create sustainable growth.

Key Advantages of Using the Right Retail Trends

Adopting the right retail trends provides significant benefits for businesses in Saudi Arabia’s competitive marketplace. Firstly, these trends enable companies to meet the ever-evolving expectations of a digitally empowered consumer base.

Hyper-personalised experiences, AI-powered chatbots, and frictionless payments are no longer luxuries—they’re necessities that drive customer satisfaction and retention.

Secondly, technology-driven trends such as smart inventory management, real-time analytics, and automated logistics significantly reduce operational inefficiencies. This translates into cost savings, better resource allocation, and higher profit margins.

Thirdly, models like subscriptions and loyalty programs ensure predictable revenue streams and deeper customer relationships, particularly important in a market where repeat business is key.

Moreover, aligning with emerging trends allows businesses to distinguish themselves in a saturated market. Whether through immersive AR/VR experiences or eco-conscious retailing, trend-savvy retailers can create memorable customer journeys that foster brand loyalty. Adopting trends also enhances scalability and preparedness for regional or global expansion.

In essence, the strategic use of retail trends ensures resilience, adaptability, and growth—all critical to thriving in Saudi Arabia’s increasingly digital, customer-driven retail ecosystem.

Key Retail Trends To Follow in 2025

Omnichannel Retailing

Omnichannel retailing integrates multiple touchpoints—physical stores, eCommerce platforms, mobile apps, and social media—into a seamless e-commerce customer experience.

In Saudi Arabia, where consumers expect flexibility and convenience, this trend is reshaping the way retailers interact with shoppers. Omnichannel strategies allow customers to start a transaction on one channel and complete it on another, enhancing satisfaction and driving repeat business.

Retailers are investing in unified platforms that sync inventory, customer data, and promotions across all channels. For instance, a shopper might browse products online, check availability in-store via a mobile app, and choose to pick up the purchase from a nearby outlet. Integration of real-time data ensures consistency and avoids stockouts or pricing discrepancies.

In 2025, Saudi retailers leveraging omnichannel approaches will outperform competitors by meeting customers where they are—digitally and physically. This strategy not only improves engagement and loyalty but also increases conversion rates and revenue potential.

AI-Driven Inventory Management

AI-driven inventory management uses predictive analytics and machine learning algorithms to optimise stock levels, reduce waste, and prevent shortages. In Saudi Arabia, where logistics and supply chains are being modernised, this trend is essential for retailers aiming to enhance efficiency and minimise operational costs.

Retailers use AI to forecast demand based on historical data, market trends, weather, and promotional activity. These insights help adjust orders automatically, ensuring the right products are available in the right locations at the right time. For example, AI systems can predict an uptick in demand for air conditioners ahead of the Riyadh summer.

By automating stock replenishment and identifying slow-moving products, retailers reduce holding costs and improve profitability. In 2025, Saudi businesses that integrate AI into their supply chain operations will see increased agility, reduced stockouts, and enhanced customer satisfaction—critical advantages in a highly competitive market.

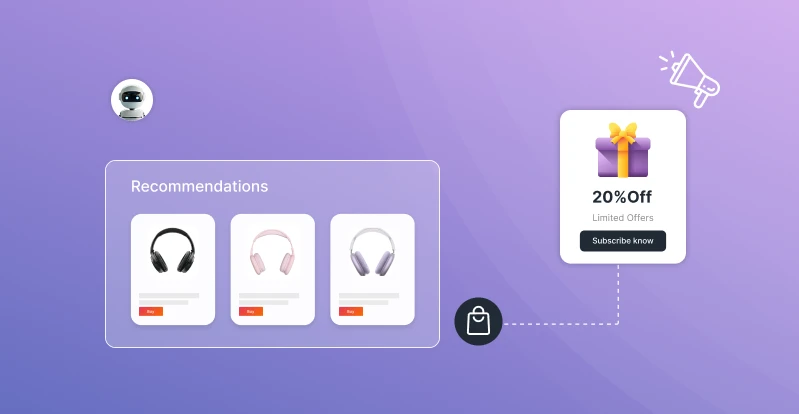

Hyper-Personalisation Through AI

AI-powered hyper-personalisation is revolutionising retail in Saudi Arabia. It involves using advanced data analytics and machine learning to deliver customised product recommendations, content, and experiences based on individual user behaviour.

This trend is particularly powerful in the Kingdom, where consumers are digitally savvy and expect high-touch, curated interactions.

Retailers are leveraging AI to dynamically change website layouts, send personalised SMS offers, and automate customer support with contextual understanding. For example, an online cosmetics brand can suggest products based on skin tone, previous purchases, and even local climate conditions in Riyadh or Jeddah.

This level of personalisation fosters loyalty and significantly boosts conversion rates. As data privacy laws evolve in Saudi Arabia, retailers must implement robust, transparent data policies to maintain trust. In 2025, businesses that prioritise hyper-personalisation will outperform competitors by offering experiences that resonate deeply with their customers.

Experiential Retail

Experiential retail focuses on delivering memorable, immersive shopping experiences rather than just products. In Saudi Arabia, malls and flagship stores are being reimagined as lifestyle destinations that combine retail, entertainment, and culture.

Retailers are incorporating interactive displays, workshops, VR experiences, and in-store events to enhance engagement. For example, beauty brands offer personalised consultations and try-on stations, while tech retailers feature product demonstrations and hands-on testing zones.

This approach encourages longer in-store visits, higher spending, and stronger brand affinity. It’s particularly effective for the luxury, electronics, and fashion sectors, where tactile experiences matter.

By 2025, experiential retail will play a critical role in attracting foot traffic and differentiating physical stores from digital counterparts in Saudi Arabia. Brands that blend digital innovation with real-world engagement will forge deeper emotional connections with consumers.

Augmented Reality (AR) Shopping Experiences

Augmented Reality (AR) is transforming the shopping experience in Saudi Arabia by allowing customers to visualise products in their real environment before making a purchase. This is especially valuable for fashion, beauty, and home décor sectors, where seeing a product in context drives more confident buying decisions.

Retailers are incorporating AR into mobile apps and websites, enabling users to try on clothing virtually, preview furniture in their living spaces, or test makeup shades on their faces. This reduces return rates and increases customer satisfaction.

Saudi consumers, particularly younger generations, are enthusiastic adopters of immersive technologies. Retailers leveraging AR not only create interactive and memorable shopping experiences but also differentiate themselves from competitors.

In 2025, AR will be a mainstream tool in Saudi retail, especially as 5G connectivity and smartphone capabilities advance. Businesses investing in AR technology will benefit from higher engagement, reduced purchase hesitancy, and improved customer loyalty.

Voice Commerce

Voice commerce is gaining popularity in Saudi Arabia as smart speakers and voice assistants become common household tools. Consumers are increasingly using voice commands to search for products, compare prices, and place orders, especially for routine or repeat purchases.

Retailers are optimising their platforms for voice search by using natural language processing and conversational AI to interpret and respond to customer queries accurately. Localised Arabic-language voice capabilities are especially important to ensure adoption in the Kingdom’s diverse market.

This hands-free shopping experience is valued for its convenience, particularly among busy consumers and the visually impaired. It also enables faster interactions and reduces the friction involved in browsing and typing.

In 2025, Saudi retailers that integrate voice commerce into their customer journey, via smart home devices, mobile apps, or call centres, will create a frictionless experience and stand out in the digital retail landscape.

Ethical and Sustainable Retailing

Ethical and sustainable retailing is becoming increasingly important in Saudi Arabia as consumers grow more environmentally and socially conscious. Shoppers are prioritising brands that demonstrate transparency, responsible sourcing, and eco-friendly practices.

Retailers are responding by adopting sustainability-focused strategies such as biodegradable packaging, carbon offsetting, and ethical labour practices. Fashion retailers, for example, are introducing recyclable collections and upcycled designs, while grocery chains are reducing single-use plastics.

Government support for sustainability through Vision 2030 initiatives has further encouraged retailers to align with national goals. Clear labelling, sustainability certifications, and awareness campaigns help educate consumers and build trust.

In 2025, retailers that embrace sustainability not only contribute to societal goals but also attract loyal customers who value ethical consumption. Businesses that fail to adapt risk being left behind by a new generation of purpose-driven shoppers.

Social Commerce

Social commerce—the practice of selling products directly through social media platforms—is booming in Saudi Arabia. With platforms like Instagram, TikTok, and Snapchat enjoying massive engagement, retailers are tapping into these channels to convert likes and views into purchases.

By integrating shopping features into social posts, stories, and livestreams, brands are making the path to purchase faster and more intuitive. Influencer partnerships and user-generated content further enhance credibility and visibility.

Saudi consumers, particularly Gen Z and millennials, enjoy discovering and buying products in real time on the same platforms they use daily for entertainment and communication. Integration with local payment systems and fast delivery enhances the overall experience.

In 2025, social commerce will be a standard sales channel in the Kingdom. Retailers that adopt a cohesive strategy—combining storytelling, visuals, and shoppable content—will effectively capture attention and drive higher conversions through these digital communities.

Buy Now, Pay Later (BNPL) Expansion

The Buy Now, Pay Later (BNPL) model is transforming retail financing in Saudi Arabia by offering consumers flexible payment options at the point of sale. With rising demand for convenient and interest-free instalment plans, BNPL services are being embraced by both online and offline retailers.

This model appeals especially to younger shoppers who prefer managing expenses without traditional credit cards. Local platforms such as Tamara and Tabby are gaining momentum by partnering with major brands and eCommerce platforms.

Retailers benefit from increased average order values and lower cart abandonment rates, while consumers enjoy affordability and ease of purchase. As financial technology matures in the Kingdom, BNPL is becoming a crucial component of retail strategies.

By 2025, BNPL will be a competitive differentiator in Saudi Arabia’s retail space. Businesses that offer seamless, secure, and Sharia-compliant instalment solutions will appeal to a broader customer base and boost long-term loyalty.

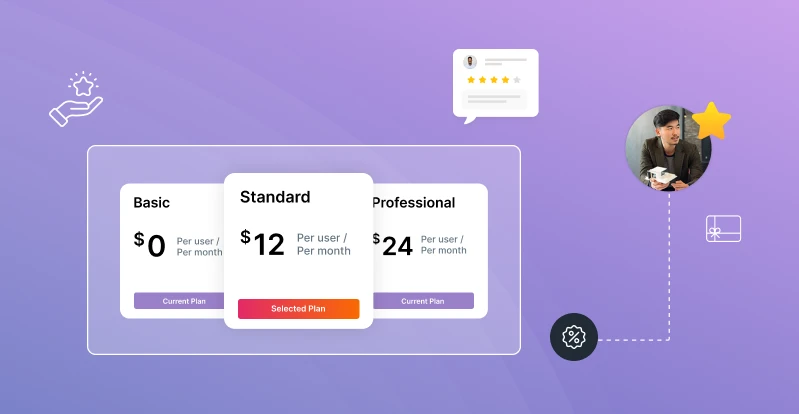

Subscription-Based Retail Models

Subscription commerce is gaining traction in Saudi Arabia as consumers seek convenience, exclusivity, and value. From fashion and beauty boxes to grocery delivery and digital content platforms, subscription models offer predictable revenue for businesses and hassle-free experiences for customers.

Saudi consumers, particularly millennials and Gen Z, are drawn to services that simplify decision-making and provide personalised selections. Retailers like lifestyle brands and online grocers are adopting this model to encourage recurring purchases, build deeper relationships, and reduce customer churn.

In a market driven by novelty and digital accessibility, subscriptions also allow for upselling, cross-selling, and the integration of loyalty rewards. Businesses can use consumer behaviour data to refine offerings, optimise delivery schedules, and improve satisfaction.

As local e-commerce payment gateways and BNPL solutions integrate seamlessly with subscription platforms, more retailers in the Kingdom will explore this trend in 2025. Those who innovate within this space will secure long-term engagement and brand advocacy.

Smart Checkout and Cashless Stores

Smart checkout systems and cashless stores are revolutionising in-store retail in Saudi Arabia. With the rise of contactless payments and digital wallets, consumers now expect faster, frictionless transactions.

Retailers are adopting solutions like self-checkout kiosks, QR code payments, facial recognition, and mobile point-of-sale (POS) systems. These innovations reduce wait times, enhance security, and free up staff to focus on customer service.

Cashless models align with Saudi Vision 2030’s goal of increasing non-cash transactions across the economy. Local businesses are integrating platforms such as STC Pay, Apple Pay, and Mada Pay to accommodate evolving consumer behaviour.

In 2025, smart checkout will be the norm in major Saudi retail environments. Retailers who embrace automation and convenience will gain a competitive edge, improving operational efficiency while delivering superior customer experiences.

Personalised Marketing Automation

Personalised marketing automation is enabling Saudi retailers to deliver targeted content, promotions, and experiences based on individual customer data. By leveraging AI, CRM systems, and behavioural analytics, businesses can segment audiences and trigger communications tailored to preferences and shopping history.

For instance, a fashion retailer might send personalised product recommendations via SMS or email after a shopper views a certain category online. Grocery stores can offer digital coupons aligned with past purchases or dietary needs.

Marketing automation tools streamline campaign management, increase engagement, and improve ROI. Integration with loyalty programs, mobile apps, and social platforms enhances the impact of personalisation across the customer journey.

In 2025, Saudi retailers investing in personalised automation will build stronger relationships, improve retention rates, and drive higher conversion rates. As customer expectations evolve, relevance and timing will be key to staying competitive.

Retail-as-a-Service (RaaS) Models

Retail-as-a-Service (RaaS) is gaining momentum in Saudi Arabia, offering modular, scalable retail solutions that help businesses reduce operational complexity and cost. RaaS platforms provide end-to-end services like logistics, fulfilment, technology infrastructure, and customer support.

This model is ideal for startups, SMEs, and international brands looking to enter the Saudi market without heavy capital investment. Retailers can rent space, share technology, or outsource operations to focus on branding and customer engagement.

Major mall operators and retail hubs are offering pop-up retail services, modular store setups, and shared backend solutions. These flexible options reduce risk and improve agility, particularly for seasonal or limited-time offerings.

By 2025, RaaS will support a dynamic and diversified retail landscape in the Kingdom. Businesses that adopt this model will benefit from faster go-to-market strategies, reduced overhead, and improved scalability.

Mobile-First Shopping Experiences

In Saudi Arabia, where mobile internet penetration is among the highest in the region, mobile-first shopping experiences are crucial for retail success. Consumers increasingly browse, compare, and purchase products using smartphones, making mobile optimisation essential.

Retailers are focusing on responsive design, fast-loading mobile sites, and intuitive navigation to enhance mobile usability. Progressive web apps (PWAs) are also gaining traction for their app-like performance without requiring downloads.

Additionally, mobile wallets, loyalty programs, and geo-targeted promotions are helping businesses personalise experiences and drive conversions. With younger demographics relying heavily on mobile interactions, brands must ensure seamless performance across all mobile touchpoints.

By 2025, mobile-first strategies will dominate the retail landscape in Saudi Arabia. Businesses that prioritise mobile UX, integrate localised payment systems, and leverage real-time engagement tools will see increased traffic, higher conversion rates, and improved customer retention.

Livestream Shopping

Livestream shopping is revolutionising how Saudi consumers discover and interact with brands. By combining entertainment, product education, and real-time purchasing, it creates a dynamic and engaging retail experience.

Retailers partner with influencers or hosts to showcase products during live broadcasts on social platforms or branded apps. Viewers can ask questions, see products in use, and make instant purchases during the stream.

Popular in categories like fashion, beauty, and electronics, livestream shopping is especially effective for launching new products or driving flash sales. Integration with social commerce tools ensures a smooth transaction process.

In 2025, Saudi retailers embracing livestream shopping will connect with audiences on a deeper level, particularly among digital-native consumers. This format not only boosts conversion rates but also builds community and brand loyalty through real-time interaction.

Data-Driven Decision Making

Retailers in Saudi Arabia are increasingly relying on data analytics to inform strategic decisions, from inventory planning to customer engagement. By collecting and analysing data from online behaviour, POS systems, and CRM tools, businesses can gain insights into trends, preferences, and operational performance.

Advanced analytics help identify high-demand products, personalise marketing campaigns, and optimise supply chains. Predictive models forecast future sales and enable proactive decision-making, reducing waste and improving ROI.

Retailers are also using data to localise assortments based on regional tastes and to tailor promotions by customer segments. Dashboards and visual analytics tools make it easier for managers to track KPIs in real-time.

By 2025, data-driven retail will be the standard in Saudi Arabia. Businesses that leverage accurate, real-time insights will be more agile, customer-centric, and competitive in an evolving market.

Loyalty and Rewards Innovation

Loyalty programs in Saudi Arabia are evolving beyond traditional points systems into personalised, value-driven experiences. Retailers are using digital tools and customer insights to craft programs that reward frequency, advocacy, and engagement.

Mobile apps and e-wallets now track purchases and issue real-time rewards, while AI helps tailor offers to individual preferences. Some retailers are introducing gamification, like scratch-and-win cards or challenges, to increase participation.

Partnership-based loyalty ecosystems are also gaining traction, allowing users to earn and redeem rewards across multiple brands. These systems foster convenience and increase the perceived value of points.

In 2025, loyalty programs that deliver meaningful, engaging experiences will outperform generic offerings. Saudi retailers that focus on hyper-personalised, omni-integrated loyalty solutions will build lasting relationships and drive repeat business.

In-Store Digital Signage and Smart Displays

In-store digital signage and smart displays are transforming the retail environment in Saudi Arabia by enhancing product visibility, interactivity, and communication. These technologies provide real-time promotions, personalised greetings, and guided product discovery.

Retailers are installing digital touchscreens, LED walls, and AI-powered kiosks that adapt messaging based on customer demographics, time of day, or purchase history. Smart displays help reduce the need for staff assistance and support self-service options.

For example, grocery stores use digital shelf labels to update pricing instantly, while fashion retailers use smart mirrors to suggest outfit combinations. These innovations improve the shopping experience and drive impulse buying.

In 2025, digitally enhanced physical spaces will define successful retail in Saudi Arabia. Businesses investing in dynamic signage and interactive technology will boost engagement, increase operational flexibility, and stay aligned with consumer expectations.

Conclusion

The retail sector in Saudi Arabia is undergoing a transformative shift shaped by digital disruption, evolving consumer expectations, and Vision 2030’s economic diversification goals.

The future of retail will be driven by personalisation, automation, seamless integration across channels, and data-informed decisions.

Adopting these innovations is essential not just to keep up but to stay ahead. Consumers in the Kingdom expect mobile-first, tech-enabled, and highly personalised shopping experiences. Businesses that embrace AI, smart displays, mobile commerce, and flexible payment options will be best positioned to meet—and exceed—these expectations.

Forward-looking models like Retail-as-a-Service, livestream shopping, and loyalty innovations provide the adaptability retailers need to thrive. The retail experience is shifting from transactional to experiential, fostering deeper brand loyalty.

As we move into 2025, it’s crucial for Saudi retailers to prioritise innovation and digital transformation. For more tailored strategies, connecting with retail experts can offer valuable insights and direction to ensure business success.