The Golden Era of Mobile Wallets & Digital Payments in 2025-26

Table of Contents

The trend of mobile wallets and payment gateways has increased significantly in most parts of the world. We have seen a significant growth in the adoption of Mobile Wallets and payment gateways over the last two years, which is expected to rise in 2026-27.

Mobile wallets are at the core of the digital payments innovation that has made it a worldwide leader. By 2025, what began as a gradual shift in the early 2010s has become the norm. As of 2025, it has over 1.2 billion mobile connections and over 950 million smartphone users (GSMA Intelligence 2025 Report).

Mobile wallet operations are at their most innovative stage to date, with over 950 million smartphone users and a fast-expanding financial infrastructure. Everywhere, from upscale malls to small kirana stores, mobile wallets and UPI payments are prevalent.

What is a Mobile Wallet?

Before discussing anything, we must first clarify what a Mobile Wallet is. A Mobile Wallet, also known as a Digital Wallet, is an electronic device or online service that enables individuals to make electronic transactions. These electronic transactions include purchasing items online or buying something from the store with the help of smartphones.

The Popularity of Mobile Wallet

After Coca-Cola initiated the idea of a financial transaction using mobile phones, this concept gained massive support in various parts of the world. Slowly and steadily, innovations, inventions, and changes were introduced in the field of mobile wallets.

As time passes, the popularity of Mobile wallets increases day by day. Mobile devices are used for movie tickets, arranging travel, and even ordering food items like Pizza. Online shopping and for petrol stations, mobile wallets are used on a vast scale.

Several developments emerged in the field of mobile wallets, which generally helped this technology gain real popularity. Scanning QR codes and cashback offers made things easy for consumers. Many organizations worldwide have made contributions to the development of mobile wallets.

Amidst all these developments, Google and Apple emerged as significant players in the mobile wallet market.

Apart from Google and Apple, many new companies have emerged and introduced their mobile wallets.

The fact is that some companies achieved significant success, while others struggled to do well.

Why Mobile Wallets Have Become a Necessity

Mobile wallets are no longer just a cash alternative; they’ve become the default payment method for millions. Key drivers include:

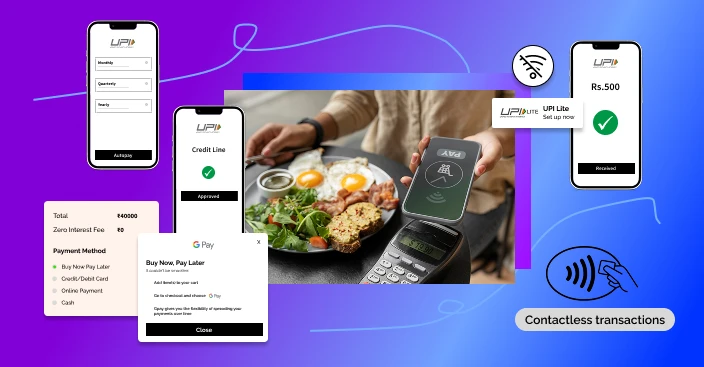

- Contactless transactions

- Buy Now, Pay Later (BNPL) integrations

- UPI Autopay & Credit Lines

- Offline Wallets (UPI Lite) for feature phone users

The digital payments market is expected to surpass $2.2 trillion by 2026, with mobile wallets and UPI apps leading this surge.

Mobile Wallet Revolution: From Transactions to Ecosystems

While UPI dominates P2P payments, wallets have evolved beyond just money transfer:

- Embedded Finance: Loans, credit cards, and insurance within apps.

- Wealth Management: Mutual funds, SIPs, and digital gold purchases.

- E-commerce & Super Apps: Payments merged with shopping, travel, food delivery, and entertainment.

According to Statista, the digital payments market in is projected to surpass with UPI accounting for more than 75% of transactions.

Mobile Wallets: Advantages and Disadvantages

All technologies in this high-profile world have their advantages and disadvantages, regardless of how superior they may be.

Similarly, Mobile Wallets also have their advantages and disadvantages.

Let’s have a brief look at these areas.

Advantages:

1) Easy accessibility: Using a mobile wallet for day-to-day transactions is straightforward. All you need to do is download the app and create a user ID and password. The best part of the mobile wallet is that you can use it anytime, anywhere, as long as your internet connection allows.

2) Security: By using a mobile wallet, users no longer have to presume the security dangers related to cash or worry whether they have enough money in their bulky physical wallets, so that mobile payments decrease theft risks of having cash on hand. Moreover, mobile payment is a secure way to make a payment.

3) A range of uses: Mobile Wallet is an all-rounder player just like Kapil Dev. Yes, you heard it right. Starting from bill payments for DTH, postpaid, and data cards, to buying air and train tickets, as well as online shopping and ordering Pizza, Mobile Wallets can be used everywhere in the digital world. And amazingly, as per NPCI 2025 reports, UPI Lite and UPI Autopay are driving micro and recurring payments at scale, enabling even offline payments.

4) Discount and Cashback Offers: Mobile wallets and Payment gateways like PayTM and Google Pay offer various kinds of cashback offers and discounts in every digital transaction, and it helps you to enjoy many incentives, freebies, and discounts. The government has also announced a list of excuses for going cashless.

Disadvantages:

1) Not always accepted: Mobile payments are not always accepted everywhere. Even in metropolitan cities like Mumbai, some shopkeepers lack confidence in mobile wallets.

2) Internet Connection: As all mobile wallets work on the internet, internet connection is one of the significant problems in many countries, where it’s tough to get a fast internet connection in most of the country.

3) Supported by certain phones: Mobile wallets do not support all phones, and that is why it’s tough to use mobile wallets on such phones.

4) Payments are bound to your phone: If your phone is lost or stolen or even if the battery dies, you are out of luck because you can’t make payments.

Challenges Still Remain:

While mobile wallets have advanced, a few hurdles persist:

- Digital Literacy Gaps: Senior citizens and remote areas still face usability challenges.

- Fraud Risks: Social engineering attacks and phishing scams target less-aware users.

- Over-Reliance on Mobile Devices: Loss of devices or battery drains can still block transactions temporarily.

Best Mobile Wallet Platform in 2025-2026

There are many mobile wallets available in the market, but only a few are the preferred choices of citizens.

Following are the lists of the best mobile wallets in 2025-2026:

Alipay

Alipay, developed by Alibaba Group, is generally held as a leading mobile wallet in China and Asia. Alibaba has an eCommerce lineage, but Alipay pretty much lets you do everything from paying utility bills to booking tickets, shopping online, and sending or receiving money. Funnily, these services don’t have a separate app of their own. All the respective services are included within the Alipay super app.

Apple Pay

Apple Pay is Apple’s mobile wallet service integrated into iPhone, Apple Watch, iPad, and Mac hardware. Apple further supports digital payments locally or online for the web and in-app purchases. You can also send money using Apple Cash. There is no separate Apple Pay app as it is built within Apple’s Wallet and navigation system.

PayPal

PayPal is now practically a household name coming from a relatively humble, or rather simple, . origin as an eCommerce payment service, evolving into a global digital wallet. Today, it supports sending and receiving money, online shopping, and bill payments in over 200 countries. PayPal does not need an outside ecosystem to run through its app and website, and is accepted on thousands of platforms globally.

Google Pay

Google Pay is not a wallet. Google Pay enables its users to transfer money from one bank account to another using their bank account details, as well as pay various types of bills with the help of UPI. In 2025, PhonePe and Google Pay together control over 75% of the UPI transactions, according to NPCI.

Amazon Pay

Amazon is expanding its business at a significant level. Most people generally think that Amazon is only serving their clients in the field of e-commerce, but the truth is very much different because Amazon is helping their clients in various other areas also, and one of the best services provided by Amazon is Amazon Pay.

Amazon Pay is a mobile wallet or a digital wallet used to do online transactions for various things like mobile recharge, DTH, electricity bill, landline bill, gas, and water bill. Amazon Pay is also used to make payments for the products that you are buying from Amazon itself, and we can use Amazon Pay for sending money to other users.

We have to make one thing very clear, Amazon has not launched any separate mobile app or website for Amazon Pay, as Amazon is providing this service in the app and website, which people are using for e-commerce purposes.

Airtel Money

Airtel is a popular cellular network, provides limited but some beneficial services to its consumers.

Just provide your KYC details, and you will get a savings account on Airtel Payments Bank, which will give you a virtual debit card for online shopping. Airtel Money also provides some other features, including mobile recharge, bill payments, and transferring money using BHIM UPI.

The app further provides offers from online travel, entertainment, and food merchants. You can get all these offers and services from Airtel Money; all you need is an Airtel SIM card.

Explore The Mobile Wallets Market

The market of Mobile Wallet is going higher and higher day by day since the demonetization. All these facts discussed above give us a conclusion that the demand for mobile wallets is a remunerative one, with investors ready to invest money.

As e-commerce continues to grow rapidly in Asia, mobile wallets have become one of the most preferred methods for online payments. Most of these wallets comprise multiple payment methods, from bank transfers to credit cards, debit cards, gift cards, and more.

According to the National Cyber Security Coordinator in the PMO, Mr. Gulshan Rai, mobile wallet transactions have increased 40 times in the last five years, and each service provider is targeting the market for its services.

This is because digital transactions are the first and favorite choice of youths, and they are helping mobile wallet companies establish an active market.

So by following all the theories mentioned above, it is very much believed that the market of mobile wallets is at its peak after the demonetization, which is helping the economy and the mindset of society in terms of digital transactions and mobile wallets.

Upcoming Trends to Watch in 2025 & Beyond

- Voice-Enabled Payments: Hindi & regional-language voice assistants simplify digital payments for non-tech-savvy users.

- AI-Powered Expense Management: Apps auto-categorize expenses and suggest saving options.

- Cross-Border Payments: UPI Global integration to allow for paying abroad seamlessly.

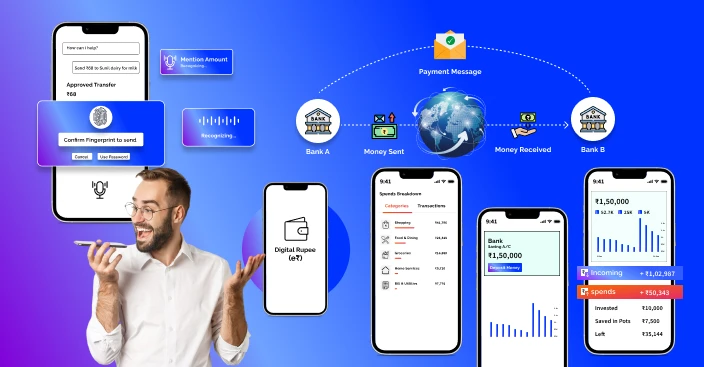

- CBDC (Central Bank Digital Currency): The integration of Digital Rupee with mobile wallets is currently under active testing. According to RBI projections, the CBDC retail pilot is expected to onboard over 1 million users by the end of 2025

Conclusion

The digital payment landscape has shifted dramatically from the early wallet days. Today, mobile wallets are no longer an option; they are a way of life.

From daily groceries to international remittances, mobile wallets are poised to handle every facet of the economy in the coming years. A 2025 survey by PwC reveals that 92% of Gen Z and Millennials prefer mobile wallets and UPI apps over traditional banking apps for everyday transactions.

With evolving technologies like UPI Lite, CBDC, BNPL, and Super Apps, 2025 and 2026 will see deeper wallet penetration across every demographic segment.

Keep your trust in digital wallets, and they’ll keep your transactions fast, safe, and rewarding.

FAQs

What is a mobile wallet?

What is a mobile wallet?

A mobile wallet (or digital wallet) is an app or service that allows you to store money digitally and make payments using your smartphone or other devices, both online and in-store.

How do mobile wallets work?

How do mobile wallets work?

Mobile wallets store your payment information securely and let you pay by scanning a QR code, tapping your phone (NFC), or directly transferring money through UPI or other payment systems.

Which are the most popular mobile wallets in 2025?

Which are the most popular mobile wallets in 2025?

Some top mobile wallets include Google Pay, PhonePe, Paytm, Apple Pay, Alipay, PayPal, Amazon Pay, and Airtel Money.

What are the common drawbacks of mobile wallets?

What are the common drawbacks of mobile wallets?

They may not be accepted everywhere, require internet connectivity, and can’t be used if your phone is lost, stolen, or has no battery.