Payment Apps

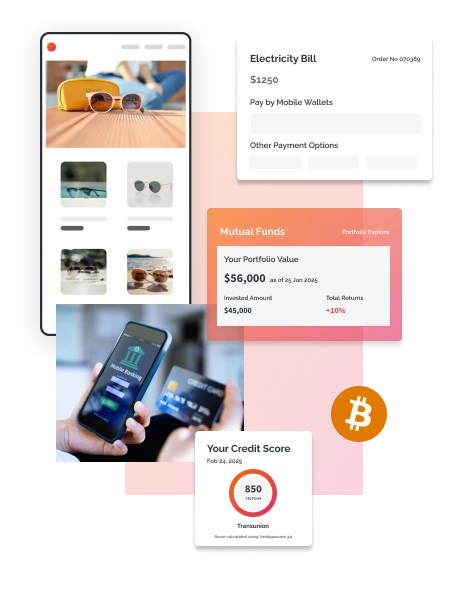

Mobile wallets, P2P payments, and payment gateways ensure seamless and secure fund transfers, purchases, and transactions. These apps focus on data protection, encryption, and user authentication to make the payment experience trustworthy and convenient for users.

...Read More

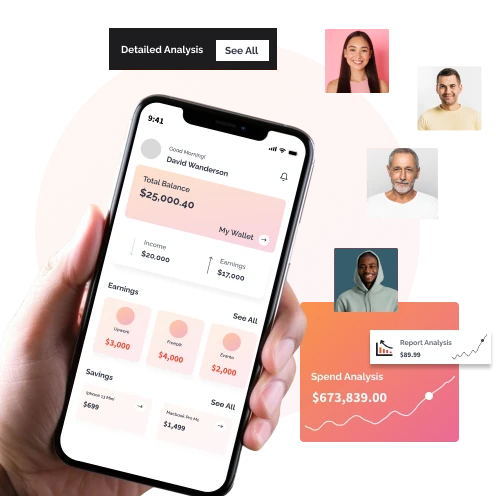

Banking Solutions

Mobile and internet banking applications, with feature-rich security capabilities, enable customers to check their account on the go. Some of the additional functions provided through these apps include account management, transferring funds, bill payments, and transaction alerts. All these services are facilitated through strong security protocols, ensuring the protection of users' information and fraud prevention.

...Read More

Investment Platforms

Stock trading, wealth management, and robo-advisors apps give the user full authority to invest. The platforms give users real-time market data, personalized investment advice, and automated portfolio management, making them make better-informed decisions that lead to efficient growth of wealth while maintaining secure transactions and data privacy.

...Read More

Lending Solutions

Loan management and P2P lending and credit-scoring apps make borrowing more fluid. Loan applications and tracking repayment and matching borrowers with lenders in a seamless P2P lending marketplace. Advanced algorithm inputs determine people's credit-worthiness, which enables fast approvals and tailored loan offers, placing both lender and borrower at ease.

...Read More

InsurTech Apps

Policy management, claims processing, and underwriting apps revolutionize the insurance industry. The applications will allow users to manage their policies, file claims, and get real-time updates. Automated underwriting and claims processing improve efficiency, reduce paperwork, and increase customer satisfaction by delivering faster and more accurate services.

...Read More

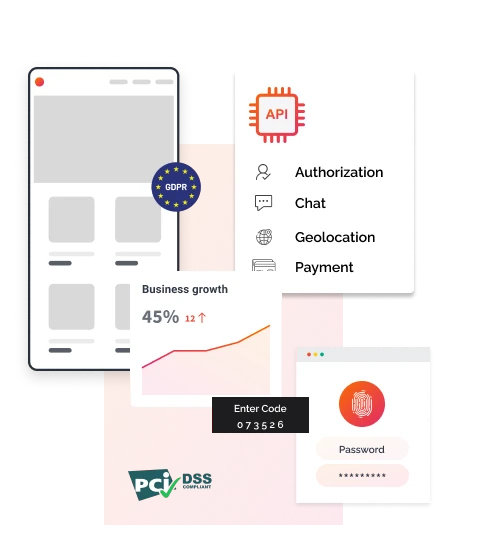

Blockchain-Based Solutions

Cryptocurrency wallets and decentralized finance (DeFi) platforms exploit blockchain technology to serve safe and clear financial services to the public. In this regard, the apps assist users in accessing their digital currencies, performing peer-to-peer transactions with others, and interacting with a portfolio of DeFi services, all while enjoying strong security and private services.

...Read More

App Store Optimization (ASO)

Adopt some tactics to get higher visibility, ratings, and downloads of your app among the stores. This can be done by metadata optimization, asking users for their reviews, and marketing the app to attract more users, which in turn will lead to the very app’s success.

...Read More

Payment Apps

Mobile wallets, P2P payments, and payment gateways ensure seamless and secure fund transfers, purchases, and transactions. These apps focus on data protection, encryption, and user authentication to make the payment experience trustworthy and convenient for users.

...Read More

Banking Solutions

Mobile and internet banking applications, with feature-rich security capabilities, enable customers to check their account on the go. Some of the additional functions provided through these apps include account management, transferring funds, bill payments, and transaction alerts. All these services are facilitated through strong security protocols, ensuring the protection of users' information and fraud prevention.

...Read More

Investment Platforms

Stock trading, wealth management, and robo-advisors apps give the user full authority to invest. The platforms give users real-time market data, personalized investment advice, and automated portfolio management, making them make better-informed decisions that lead to efficient growth of wealth while maintaining secure transactions and data privacy.

...Read More

Lending Solutions

Loan management and P2P lending and credit-scoring apps make borrowing more fluid. Loan applications and tracking repayment and matching borrowers with lenders in a seamless P2P lending marketplace. Advanced algorithm inputs determine people's credit-worthiness, which enables fast approvals and tailored loan offers, placing both lender and borrower at ease.

...Read More

InsurTech Apps

Policy management, claims processing, and underwriting apps revolutionize the insurance industry. The applications will allow users to manage their policies, file claims, and get real-time updates. Automated underwriting and claims processing improve efficiency, reduce paperwork, and increase customer satisfaction by delivering faster and more accurate services.

...Read More

Blockchain-Based Solutions

Cryptocurrency wallets and decentralized finance (DeFi) platforms exploit blockchain technology to serve safe and clear financial services to the public. In this regard, the apps assist users in accessing their digital currencies, performing peer-to-peer transactions with others, and interacting with a portfolio of DeFi services, all while enjoying strong security and private services.

...Read More

App Store Optimization (ASO)

Adopt some tactics to get higher visibility, ratings, and downloads of your app among the stores. This can be done by metadata optimization, asking users for their reviews, and marketing the app to attract more users, which in turn will lead to the very app’s success.

...Read More