10 Payment Security Measures to Deal E-commerce in 2021-22

Table of Contents

Security is one of the most serious issues if we talk about eCommerce. Cases like identity theft and payment fraud are apparently increasing day by day in eCommerce segment.

It is of utmost importance for store owners to give their customers safe and secure shopping environment.

In 9 years, I have seen a lot of cases in which most of the store owners have experienced too serious issues like payment fraud and hack due to security consequences.

Whenever I or my team offers a consultation to the client, we embark the importance of secure eCommerce website that to mainly concerning payment security.

In this article, I will be sharing the most important payment security measures to deal eCommerce security threats. My research and experience always advocate me to share the importance of the security audits in ensuring the protection of store from all security threats.

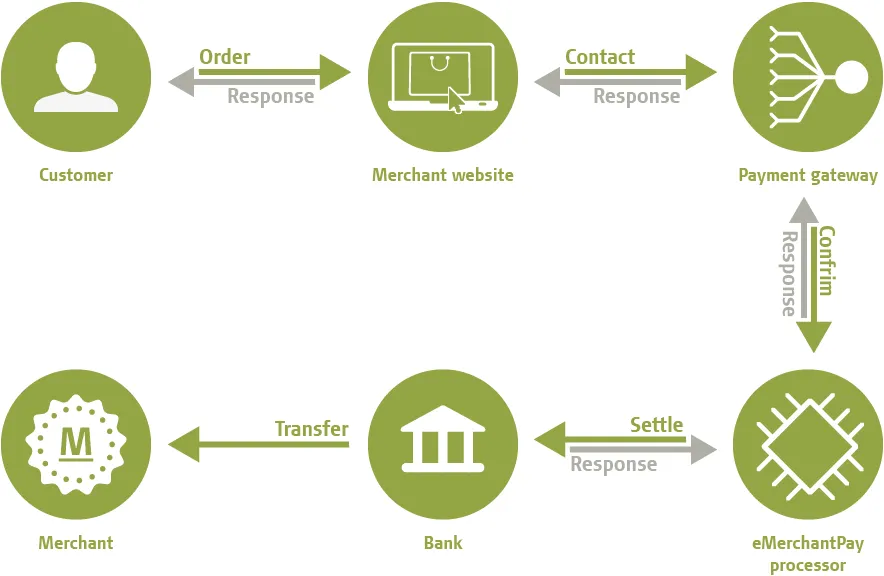

1. Partner with a processor who knows online payments

Choosing the right payment processor is a prior step for accepting online payments from the customers through credit card. Selection of payment processing partner should be done with utmost care as its experience can help the client to comply with the payment card industry data security standards (PCI DSS).

All you need is an experienced partner who can give you all-time support and maintains the PCI compliance for you by implementing various approaches like a training program, Vulnerability Assessment and full-time customer support. Some processors even reimburse the money for monetary loss in case of fraud event that occurs through a data breach.

Thus it is extremely important to have a partner who had experience and can even understand everything about the payment security and precautions.

2. Monitored suspicious purchasing activity

As an owner of the eCommerce store, you should be aware of the various types of suspicious activities that could be the reason for fraud.

One of my client name Max from Germany who was having a fashion eCommerce store has faced the security consequences due to this problem.

Related Article: eCommerce Security: 7 Ways To Protect E-Commerce Customer Data

Once a person who logged in to his website and made huge order from the same IP address but used different credit cards. Max was completely unaware of the issue and thus failed to understand the behaviour and pattern of the customer indicated that single person is using multiple stolen credit cards to make purchases which lead to serious repercussion.

Large order raises too many doubts and especially the one which was requested for next day Shipping. But this activity alone is not enough to identify a transaction as fraud.

3. Address verification system for all transaction

It is extremely important for store owners to predict and analyze that the person making the purchase is truly a cardholder. Various techniques can be utilized to prevent this fraud. Implementing the address verification system in the eCommerce store is the best way to analyze and verify the fraud.

The system will check if the billing address is correct by verifying it with cardholder’s data from the issuing bank. As a result person with a stolen card or card number doesn’t have the access to the wrong billing address.

Incorrect billing address may not necessarily mean that the transaction is fraudulent hence it is advisable to take additional security measures to identify the customer.

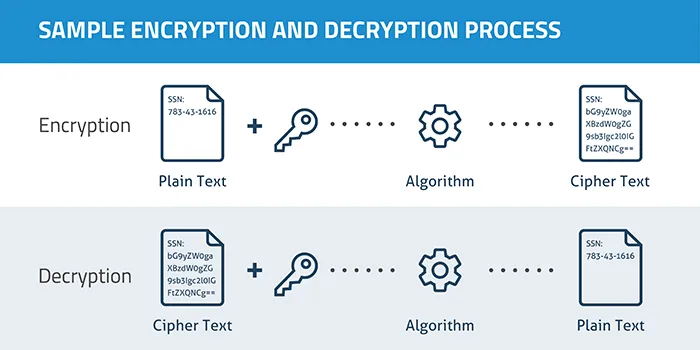

4. The Encryption Approach

Encryption is a method of converting the original message into encrypted text, which should be too complex to understand and even difficult for a hacker to decode. The main idea of encryption is to ensure security and safety of the data and its transmission.

Encryption can be done through various techniques but the choice totally depends on the context and the requirements. Some of the famous techniques in eCommerce are:-

- Public key encryption

- Symmetric key encryption

5. Secure Socket Layer (SSL)

Secure socket layer is the most consistent security model used and developed for eCommerce business, secured through its payment channel.

Through the SSL, transmission of data is encrypted, client and server information is authenticated and message integrity for TCP/IP connections. The protocol is design to prevent tampering of information and forgery while transmitting data over the internet between interacting applications.

6. Secure Hypertext Transfer Protocol (S-HTTP)

S-HTTP is an advanced version of normal HTTP internet protocol with enhanced security which ensures secure authentication, public key encryption and digital signatures.

Secure HTTP enabled website makes the transaction more secure by negotiating encryptions schemes used between a server and the clients. It can seamlessly integrate with the HTTP and ensure an optimal end-user security with different defence mechanisms.

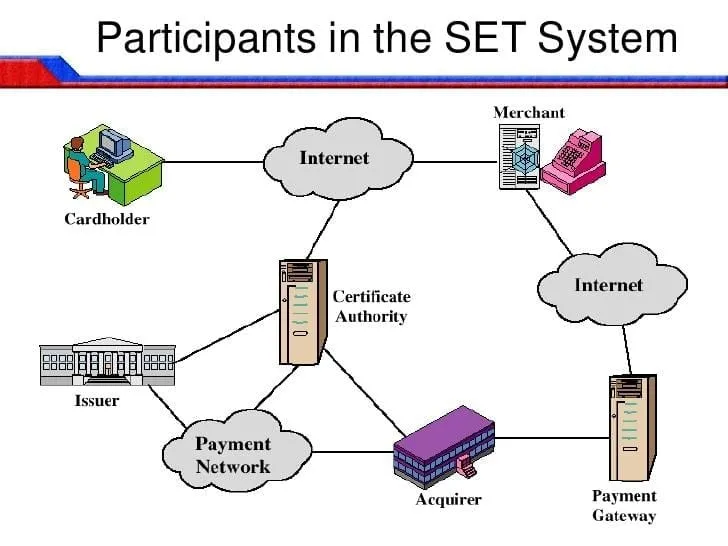

7. Secure Electronic Transaction (SET)

SET is a joint collaboration by MasterCard and VISA which ensures that safety of all parties involved in electronic payments of an eCommerce transaction. It is designed to handle complex and critical functions like:

- Authenticating the cardholders and merchants

- Confidentiality of information and payment data

- Define protocols & electronic security service, providers

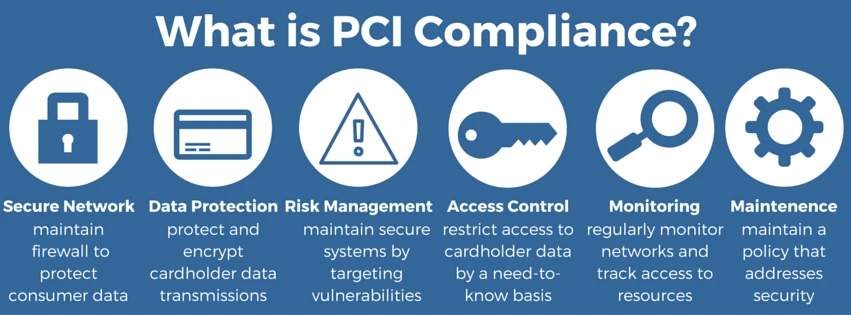

8. Payment Card Industry (PCI) Compliance

The payment card industry security standard council was formed in the year 2006. It ensures that the companies who deal with the accepting, processing, storing and transmitting credit card information have to maintain a secure environment.

PCI DSS is not a law in itself but a standard made by a collaboration of various branded card company like Visa, Mastercard, JCB, AMEX and Discover. If your company is not PCI compliant has to face some serious consequences like fines, card replacement cost, costly forensic audits and off-course lost to brand image.

Image Source: cybersecon

As it is said Wise man must always be proactive than reactive because little upfront effort and cost is required to reduce your risk from serious consequences.

9. Safe Login Screen

Development of Secure eCommerce website straight away starts from the Login Page. You are half way done if login access to the website is secure. Otherwise, it will be easy for the hackers to infiltrate and get access to sensitive data.

Implementing this safety protocol is moderately easy, but it can efficiently ward off many security threats.

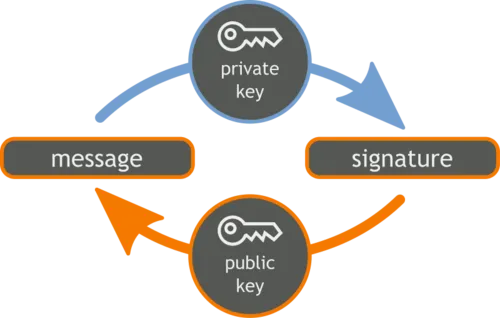

10. Digital Signature

A digital signature means giving a unique identity to your message. Actually, it is a process of encrypting the message with the private specifically used for verification purpose.

The linkage between data and the signature doesn’t allow any alteration and if anyhow data is altered signature is automatically invalidated.

Thus digital signature helps to maintain the authority and confidentiality of the data.

Conclusion:

I think after snooping through this article you may surely be able to relate your security problems if any with the absence of any one of this security measures. These 10 measures are like bits and piece of the eCommerce payment security that needs to be taken care of while developing a website.

The payment system is the most critical part of any eCommerce website. It’s the place where the money of both the entities is at stake if proper security is not ensured.

If you had been already through any of the security attacks or need any kind of assistance to develop a secure eCommerce website which can give a boost to your business feel free to write me in the comment section or can even contact me for the free consultation at Magneto IT Solutions